| Committee membership | No. of meetings 2018: 6 | Main committee responsibilities |

| Director | Attendance | |

E. Lindqvist

I.B. Duncan

P. Larmon

L. Chahbazi | 6

6

6

6 | - Responsibility for setting the remuneration policy for all executive directors and the Company's Chair.

- Recommend and monitor the level and structure of remuneration for senior management.

- Review the ongoing appropriateness and relevance of the remuneration policy.

- Appoint remuneration consultants.

- Approve the design of and determine targets for executive directors' and other senior executives' performance-related pay schemes.

- Review the design of all share incentive plans for approval by the Board and shareholders. Determine whether awards will be made on an annual basis.

These responsibilities are currently under review based on the contents of the revised Corporate Governance Code. |

Chair's letter

As Chair of the Remuneration Committee ('the Committee') and on behalf of the Board of Directors, I am pleased to present our Board report on remuneration for the 2018 financial year, in line with the requirements of the Large and Medium sized Companies and Groups (Accounts and Reports) (Amendment) Regulations 2013.

Structure of report

This year, in accordance with regulatory requirements, we will bring a new policy to shareholders at the 2019 AGM, at which point our previous policy (as approved at the 2016 AGM), expires. Our report is therefore structured as follows:

The UK Corporate Governance Code

The revised UK Corporate Governance Code represents some of the most significant changes to the work of the Committee to occur in recent years. The Committee fully endorses the requirements and underlying intent of the Code and we will continue to ensure we operate in compliance with its requirements. Focusing on simplicity and strategic alignment is fundamental to our thinking, alongside a desire to create long-term alignment between management and the shareholder experience. We also recognise the importance of considering wider stakeholders – including our employees – in our decision making processes. The Committee is working together with the Company's human resources team to ensure the Committee can best support the Board in its new overarching responsibility to ensure workforce policies and practices are in line with culture and strategy, and will report on our approach in due course.

In developing the revised Policy we considered the Principles prescribed by the revised Code around Clarity, Simplicity, Risk, Predictability, Proportionality and Alignment to culture. We believe that our new policy fully and appropriately addresses each of these areas.

Business performance and incentive outcomes for 2018

Bodycote has performed strongly through 2018, with Group revenue growth of 5.6% after a negative impact from foreign exchange of 1.4%. Across all our core markets, revenues have grown significantly, with 8% growth in civil aviation. Through a targeted programme of investments in Emerging Markets we have delivered revenue of 21%, and our Specialist Technologies business grew revenues at 12%. Group return on sales also increased 1 percentage point to 19.0%. We believe that the incentive payouts we have made to our executive directors reflects this performance and is aligned to the overall performance of the Company. As such, the Committee determined that no discretionary adjustments (either upward or downward) would be required from the formulaic outcomes.

Annual bonus

We have faced challenging cost inflation headwinds, but through price increases and a continued focus on cost discipline and operational efficiencies we have been able to recover the majority of the impact this has had. The Group's headline operating profit grew 12% to £138.3m. Our headline operating cash flow has also grown by 15% to £128.7m, supporting our ability to return cash to our shareholders. As these measures are our core internal financial metrics they form the core annual bonus metrics. The annual bonus also contains a personal element (weighted to 13% of the total) that primarily reflects how our executive directors have delivered on our strategic goals, and in particular our investments in growth. Given the strength of our strategic implementation and the extent to which this has been reflected in financial performance, the outcome under the personal measure of 80% for the CEO and 70% for the CFO are appropriate in the context of the overall performance of the Business.

The annual bonus therefore paid out at 68.5% of maximum for the CEO and 67.2% of maximum for the CFO, of which 35% will be deferred into shares for three years, in line with our approved policy for bonus deferral.

Long-term incentive

The Company's principal long-term incentive, the Bodycote Incentive Plan (BIP) is based on performance against return on capital employed (ROCE) and earnings per share (EPS) targets over a three year period. Our ongoing focus on operating efficiency, margins, and targeted investments in high growth markets has supported earnings development over the three year period despite the challenging environment, resulting in an outcome of 100% under this measure. Strong returns have also been delivered, helped by the focus on capital investment in specialist markets, and ROCE performance was 78.5% of maximum.

The 2015 Co-Investment Plan (CIP) is based on absolute total shareholder returns growth, and the TSR CAGR value of 34.1% we have delivered over the three year performance period is reflected in a final vesting under this plan of 98.4%. This plan no longer forms part of our active policy and this represents the final vesting under the CIP.

Revised remuneration policy

Through the course of the year the Committee has considered carefully our strategic objectives and how our incentive structure (as approved at the 2016 AGM) supports this. We also recognise the commentary in the Code that relates to incentive arrangements, and the views of investors and proxy bodies on different models of pay and package structure. We firmly believe that our current structure continues to be fit for purpose, and we will therefore not be proposing any significant changes to our new policy (which we currently anticipate will run to AGM 2022). In addition, we believe that the structure in totality is well aligned to the purpose and values of the business.

We will however make a number of small amendments to ensure we are aligned with the relevant areas of best practice, including:

- Increasing our shareholding requirement for the CFO to 200% of salary.

- Incorporating a formal two year post-vest holding period for the BIP into our policy.

- In recognition of the views of shareholders and the revised Code, our pension provisions for new Executive Directors are being reduced. The company contribution will be set at the time of appointment to align to that of other employees as part of our ongoing process to align Executive Director's pension to those of the other employees legacy contributions (or cash equivalents) of up to and including 25% of salary remaining in place for current Executive Directors.

- We are further increasing the protection our clawback and malus policy provides through extension of our trigger clauses to include reputational damage.

In reviewing our policy we consulted extensively with our largest shareholders together with proxy agencies, and discussed the rationale for our proposals. We received an overwhelmingly positive response, recognising the success of our historic remuneration framework in driving exceptional business performance over the last three-year period and the alignment of our new proposals with investor expectations and corporate governance requirements.

We further consulted with shareholders concerning a one-off salary increase of 10% for our Chief Executive reflecting the increased complexity and significant growth of our Company in recent years, coupled with an excellent performance in his role. However, reflecting feedback received from shareholders, we have decided to amend our original decision and Stephen Harris will instead receive an inflationary increase of 3%, in line with the average increase of the wider UK workforce.

Application of policy for 2019

We set out below a brief overview of our intended application of policy for 2019.

- Base salaries: The Committee is also proposing an increase of 3% for the CEO and the CFO in line with the general employee population.

- Benefits and pension: There will be no changes to benefits and pension provided to our executive directors.

- Annual bonus: The maximum bonus opportunity remains 200% of salary for the CEO and 150% of salary for the CFO, with 35% of any bonus paid being deferred in shares for three years. The measures and weightings used have been reviewed and we believe a bonus consisting of 77% headline operating profit, 10% headline operating cash management and 13% personal objectives continues to enable the annual bonus to be aligned to the Company's strategy and ensures our executives are focused on delivery of improved profitability and control on working capital.

- Bodycote Incentive Plan (BIP): Award levels will remain 175% of salary for Executive Directors. Similarly, measures and weightings have been reviewed and we believe the equal focus on returns and earnings is strongly aligned with our strategic priorities. The growth of our business and our ability to deliver strong and sustainable returns to investors is based on delivery of an effective deployment of capital in rapid growth areas and on acquisitions, which ROCE and EPS continue to create alignment to.

I trust the information presented in this report enables our shareholders to understand both how we have operated our remuneration policy over the year and the rationale for our decision making. We remain fully committed to continuing an open and transparent dialogue with our shareholders. I would welcome your views on our policy, the content of this report or any other items you would like to discuss and I look forward to meeting you and answering any questions you may have at the AGM.

E. Lindqvist

Chair of the Remuneration Committee

8 March 2019

This report has been structured to support the reader in quickly and easily accessing relevant information.

- Legacy contributions for cash equivalents of up to and including 25% of salary remain in place for current Executive Directors.

Section A

Remuneration at a glance

This introduction provides a high-level overview of the remuneration received by our Executive Directors. Full details can be found in the Annual Report on Remuneration.

Single figure of remuneration for Executive Directors

| Incumbent | Financial year | Total salary/fees

(£000) | Total pension

(£000) | Total other

benefits

(£000)1 | Annual bonus

(£000) | Total BIP2

(£000) | Total CIP

(£000) | Dividend equivalent for BIP + CIP

(£000) | Total

(£000) |

| S.C.Harris | 2018 | 542 | 135 | 22 | 742 | 1,0402 | 50 | 118 | 2,649 |

| 2017 | 527 | 132 | 27 | 1,031 | 5003 | 34 | 44 | 2,295 |

| D.Yates | 2018 | 391 | 98 | 17 | 394 | _ | _ | _ | 900 |

| 2017 | 380 | 95 | 26 | 548 | – | – | – | 1,049 |

- Other benefits consist of company car (or allowance), family level private medical insurance, salary supplement in lieu of pension life assurance cover and sick pay. Certain other expenses incurred in pursuit of bona fide business activities are, under UK tax regulations, treated as a taxable benefit in kind, and the director has received grossed up compensation for this in order to leave him in a neutral position.

- An estimated market price at vesting was used and this was calculated as the three months average from 1 October to 31 December 2018 of £7.68.

- An estimated share price of £9.11 at close of markets on 5 March 2018 was used to estimate the value in the 2017 Annual Report. This has now been updated with the share price of £9.33 at the close of markets on the vesting date of 12 March 2018.

Annual performance related bonus

The 2018 annual bonus was based on three elements – headline operating profit, headline cash management and personal objectives. Stretching targets were set in the context of the challenging market conditions we faced and the investments that were planned in the year. Following strong performance in the year the bonus paid out at 68.5% for the CEO and 67.2% for the CFO, 35% of the award will be deferred in shares for both the CEO and the CFO. The performance targets and actual performance are set out below. Targets are set on a constant currency basis so as to remove the positive and negative impact of currency fluctuations from the annual bonus.

| % of award | Threshold | Target | Maximum | Actual performance achieved | Outcome |

| S.C. Harris | D. Yates |

| % of max | % of salary | % of max | % of salary |

| Group headline operating profit | 77% | £124.5m | £139.3m | £146.3m | £138.3m | 77% | 96% | 77% | 72% |

| Group headline operating cash flow | 10% | £104.4m | £116.0m | £116.0m | £128.7m | 100% | 20% | 100% | 15% |

| Personal scorecard | 13% | | | | | 80% | 21% | 70% | 14% |

| | | | | Total | 69% | 137% | 67% | 101% |

Bodycote Incentive Plan (BIP)

BIP awards made in 2016 had a three-year performance period ending on 31 December 2018, with 50% of the award subject to satisfaction of a ROCE target and 50% subject to the headline earnings per share (EPS) target. Over this period our total shareholder returns have increased by 34%, demonstrating the returns we have made to shareholders. This is reflected in the 89.3% of max vesting of the BIP. The threshold and maximum targets along with the vesting schedule are set out in the tables below.

| ROCE | Headline EPS |

| Performance target | Vesting of element

(% of maximum) | Performance target | Vesting of element

(% of maximum) |

| Threshold performance | 15.5% | 0% | 31.7p | 0% |

| Maximum performance | 23.0% | 100% | 52.0p | 100% |

| Performance achieved | 20.5% | 39.3% | 55.9p | 50% |

| 2016 BIP outcome | |

| S.C. Harris | 89.3% of maximum opportunity |

| D. Yates | n/a |

| D Landless (retired 31 Dec 16) | The 2016 BIP award lapsed on D Landless's leaving date |

Legacy Co-Investment Plan (CIP)

Until 2015 Executive Directors were invited annually to purchase shares up to 40% of basic salary (net of tax) against which performance based matching shares are granted on a 1:1 basis. CIP awards are subject to an absolute TSR target. No further awards will be made under this plan and the 2015 CIP that vested in 2018 was the final such award. The CIP awards made in 2015 had a three-year performance period ending on 30 April 2018.

The absolute TSR performance targets applicable to this award are set out below.

| Absolute TSR performance target | Vesting level |

| 4% CAGR + CPI | 50% (0.5:1 match) |

| 10% CAGR + CPI | 100% (1:1 match) |

Over the three-year period, the Group achieved absolute annual TSR growth of 11.6%, reflecting the value we have delivered to our shareholders over this period. This performance resulted in a vesting of 98.4% under the plan. The number and value of shares which vested for S.C. Harris is set out on in the Annual report on remuneration. As D.F. Landless is no longer an Executive Director, vesting under this plan to him is set out under payments to past directors.

Shareholding requirements

Executive directors and other senior executives are expected, within five years of appointment, to build up a shareholding in the Company. For the purposes of this requirement, only beneficially owned shares and the value of deferred shares under the annual bonus will be counted. The table below sets out the minimum shareholding requirements, as a percentage of salary, for the Chief Executive and for the Chief Financial Officer, noting that both holding requirements have been reached.

| Shareholding requirements | Minimum shareholding requirement | Current shareholding1 |

| S.C. Harris | 200% | 291% |

| D. Yates | 200% | 372% |

- At the 31 December 2018 share price.

Implementation of the Remuneration Policy in 2019

The table below provides information on how our Remuneration Policy will be implemented in 2019.

| Element of pay | Implementation for 2019 |

| Total salary | Base salaries are reviewed on an annual basis. S.C. Harris will receive a salary of £558,181 in 2019, an increase of 3% (2018: £541,923). D. Yates will receive a salary of £402,751 in 2019, an increase of 3% (2018: £391,020). Note that Non-Executive Director fees will next be reviewed at the March 2019 meeting of the Committee, and the outcome of this review will be disclosed in the following year's report. |

| Pension and benefits | No changes proposed.

Executive Directors receive a salary supplement in lieu of pension at a rate of 25% of base salary. |

| Annual bonus | No change to maximum opportunity: 200% of base salary for CEO, 150% of base salary for CFO. The performance measures and their relative weightings also remain unchanged: 77% operating profit, 10% operating cash management and 13% personal objectives. The Committee reviews the performance measures and targets on an annual basis to ensure that they remain appropriately aligned to the overall business strategy but do not encourage excessive risk taking. The Committee has determined that performance targets will not be disclosed on a prospective basis for reasons of commercial sensitivity, but will be disclosed on a retrospective basis in next year's Annual Report on Remuneration to the extent that the Committee determines that the measures are no longer commercially sensitive. |

| Bodycote Incentive Plan (BIP) | No change to maximum opportunity: 175% of base salary for Executive Directors. The performance measures and their relative weightings also remain unchanged: 50% ROCE and 50% headline EPS. The targets for the 2019 BIP awards are disclosed below and ensure that the Committee are able to deliver upper quartile reward for upper quartile performance. ROCE targets currently do not reflect the impact anticipated from IFRS 16 (leases) and the Committee is currently still to determine whether this should be reflected in these targets. |

| BIP targets for 2019 award |

| Performance metric | Headline EPS | ROCE* |

| Weighting (% of total award) | 50% | 50% |

| Performance period | 3 years | 3 years |

| Threshold performance | 56p | 15% |

| Vesting level | 0% | 0% |

| Maximum performance | 64p | 23% |

| Vesting level | Full vesting | Full vesting |

| EPS underpin | 47.6p | |

| * on a pre-IFRS 16 basis During the year, the Committee reviewed the BIP Structure and measures in the context of our strategic priotities over the coming years. The Committee determined that the current framework continues to appropriately support delivery of our strategic plan. |

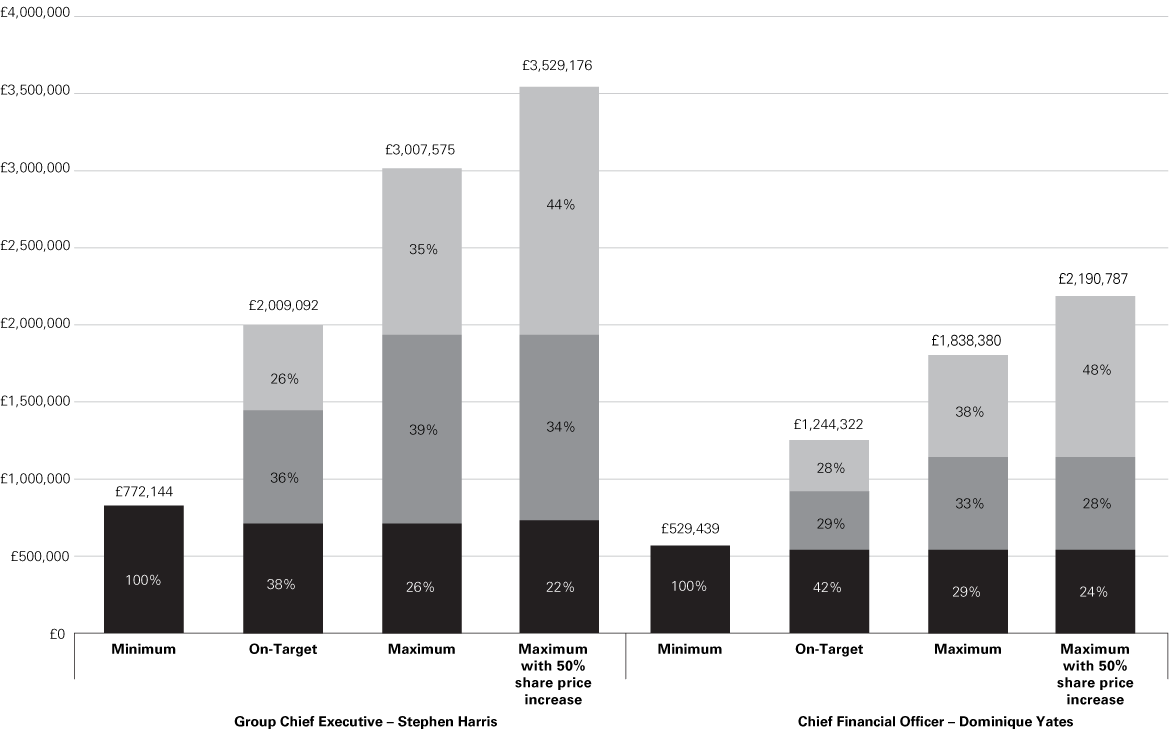

Illustration of application of remuneration policy for 2019

The remuneration package for the Executive Directors is designed to provide an appropriate balance between fixed and variable performance-related components. The Committee is satisfied that the composition and structure of the remuneration package is appropriate, clearly supports the Company's strategic ambitions and does not incentivise inappropriate risk taking. This is reviewed on an annual basis. The chart below sets out illustrations of the impact of share price appreciation on the composition and value of each Executive Director's remuneration package, should they achieve minimum, at-target or maximum performance. This disclosure is in line with The Companies (Miscellaneous Reporting) Regulations 2018.

- Fixed pay

- Annual Bonus

- Long Term Incentive

For the purposes of the above analysis, the following methodology has been used:

- Fixed elements comprise base salary and other benefits:

- Base salary reflects the base salary as at 1 January 2019.

- Benefits reflect benefits received in 2018 (including pension).

- For on-target performance, an assumption of 60% of annual bonus is applied and vesting of 50% of the maximum for the BIP.

- For the minimum, on-target and maximum basis bars no share price increase has been assumed or dividend reinvestment.

- Fixed elements are salary, benefits and pension.

- Annual variable element is the annual bonus both cash and deferred shares.

- Long-term variable element is the BIP award and dividend equivalents.

Annual report on remuneration

This section provides details of remuneration outcomes for executive directors who served during the financial year ended 31 December 2018. This section of the report is audited and subject to an advisory vote by shareholders at the 2019 AGM.

Auditable section

Total single figure table

| Incumbent | Financial year | Total salary/

fees

(£000) | Total pension

(£000) | Total other

benefits1

(£000) | Annual bonus

(£000) | Total BIP

(£000) | BIP value at grant price (£000) | Share price gain

on vesting of BIP between grant and vest date | Total CIP4

(£000) | Total (£000) |

| Executive Directors | | | | | | | | | |

| S.C. Harris | 2018 | 542 | 135 | 22 | 742 | 1,1542 | 782 | 259 | 54 | 2,649 |

| 2017 | 527 | 132 | 27 | 1,031 | 5413 | 408 | 89 | 37 | 2,295 |

| D. Yates | 2018 | 391 | 98 | 17 | 394 | -- | -- | -- | -- | 900 |

| 2017 | 380 | 95 | 26 | 548 | – | – | – | – | 1,049 |

| Non-Executive Directors | | | | | | | | | |

| A.C. Quinn6 | 2018 | 225 | – | – | – | – | – | – | – | 225 |

| 2017 | – | – | – | – | – | – | – | – | – |

| A.M. Thomson5 | 2018 | – | – | – | – | – | – | – | – | – |

| 2017 | 200 | – | 1 | – | – | – | – | – | 201 |

| P. Larmon | 2018 | 56 | – | 2 | – | – | – | – | – | 58 |

| 2017 | 54 | – | 6 | – | – | – | – | – | 60 |

| E. Lindqvist | 2018 | 63 | – | – | – | – | – | – | – | 63 |

| 2017 | 63 | – | 2 | – | – | – | – | – | 65 |

| I.B. Duncan | 2018 | 74 | – | – | – | – | – | – | – | 74 |

| 2017 | 72 | – | – | – | – | – | – | – | 72 |

| L. Chahbazi7 | 2018 | 56 | – | – | – | – | – | – | – | 56 |

| 2017 | – | – | – | – | – | – | – | – | – |

Notes accompanying the total single figure table

- Other benefits consist of company car (or allowance), family level private medical insurance, life assurance cover and sick pay. Certain other expenses incurred in pursuit of bona fide business activities are, under UK tax regulations, treated as a taxable benefit in kind, and the directors have received grossed up compensation for this in order to leave him/her in a neutral position.

- The 2018 figures relate to BIP awards made in 2016 with performance periods ending on 31 December 2018. Shares vested as the targets were achieved at 156.2% out of 175% (equivalent to 89.3% of maximum opportunity). This includes dividend equivalents. For 2018 dividend equivalents for S.C. Harris were £114,063. An estimated market price at vesting was used of £7.68 calculated as the three-month average from 1 October to 31 December 2018.

- This included dividend equivalents. An estimated share price of £9.11 at close of markets on 5 March 2018 was used to estimate the value in the 2017 Annual Report. This has now been updated with the share price of £9.33 at the close of markets on the vesting date of 12 March 2018.

- The 2018 figures relate to CIP awards made in 2015 with performance periods ending 30 April 2018. The shares vested on 31 May 2018 at a share price of £9.93. This includes dividend equivalents. For 2018, dividend equivalents for S.C. Harris were £4,191.

- A. Thomson retired as Chairman and Non-Executive director on 31 December 2017.

- A.C. Quinn commenced as Chair on 1 January 2018.

- L. Chahbazi commenced as Non-Executive director on 1 January 2018.

The base salaries of the Executive Directors are reviewed in January every year. As described in Section B: Directors' Remuneration Policy, a number of factors are taken into account when salaries are reviewed, including companies of a similar size and complexity, and the individual's role, experience and performance, as well as a consideration of market level salaries payable in FTSE 250. The table below sets out the base salary figures for 2019 along with comparative figures for 2018.

| Name | Position | Salary from 1 January 2018 | Salary from 1 January 2019 | Salary increase |

| S.C. Harris | Group Chief Executive | £541,923 | £558,181 | 3% |

| D. Yates | Chief Financial Officer | £391,020 | £402,751 | 3% |

Pension

S.C. Harris and D. Yates are entitled to a salary supplement in lieu of pension at a rate of 25% of basic salary. In addition, a death in service benefit of eight times basic salary is payable.

Taxable benefits

The Group provides other cash benefits and benefits in kind to directors as well as sick pay and life insurance. These include the provision of company car (or allowance) and family level private medical insurance.

| Name | Car/car allowance | Fuel | Healthcare | Other taxable

benefits* |

| S.C. Harris | £17,560 | £2,400 | £1,711 | - |

| D. Yates | £12,000 | £1,200 | – | £3,499 |

* Certain other expenses incurred in pursuit of bona fide business activities are, under UK tax regulations, treated as a taxable benefit in kind, and the director has received grossed up compensation for this in order to leave him/her in a neutral position.

Incentive outcomes for 2018

Annual performance related bonus

The table below provides the details of the annual bonus awards received in respect of the Group and individual performances in the 2018 financial year.

The annual bonus potential for the period to 31 December 2018 for Executive Directors was split 77% in respect of Group headline operating profit, 10% on Group headline operating cash flow and 13% on personal strategic objectives. These performance conditions and their respective weightings reflected the Committee's belief that any incentive compensation should be linked both to the overall performance of the Group and to those areas of the business that the relevant individual can directly influence.

Stretching targets were set in the context of the challenging market conditions we faced and the investments that were planned in the year. Following strong performance in 2018, the bonus paid out at 68.5% for the CEO and 67.2% for the CFO, 35% of the award will be deferred in shares, for the both the CEO and the CFO. The performance targets and actual performance are set out below.

| % of award | Threshold | Target | Maximum | Actual performance achieved | Outcome |

| S.C. Harris | D. Yates |

% of

max | % of

salary | % of

max | % of

salary |

| Group headline operating profit | 77% | £124.5m | £139.3m | £146.3m | £138.3m | 77% | 96% | 77% | 72% |

| Group headline operating cash flow | 10% | £104.4m | £116.0m | £116.0m | £128.7m | 100% | 20% | 100% | 15% |

| Personal scorecard | 13% | | | | | 80% | 21% | 70% | 14% |

| | | | | Total | 69% | 137% | 67% | 101% |

Personal Scorecard

| Executive Director | Stephen Harris |

| Overview | For 2018 Stephen's objectives were: drive growth in emerging markets, drive increased growth in Specialist Technologies, drive sales strategy forward, ensure ERP system is reviewed, transition leadership of selected internal departments, provide SHE leadership and support internal processes |

| Key achievements in the year | - As reflected in performance under our core EPS measure, the Group delivered strong top line sales growth of 5.6% in 2018, which exceeded the outperformance target the Committee had agreed with the CEO.

- Specific focus areas for the CEO were the achievement of year on year growth in Specialist Technologies and emerging market revenues. In 2018 Specialist Technologies sales grew by 12% on 2017 and emerging markets grew by 21%, in both cases outperforming the objectives.

- The Board tasked the CEO with increasing the levels of sales. Achievement here was in line with the target set.

- The Group is reviewing its Enterprise Resource Planning (ERP) programme that will ensure our IT systems support the effective and efficient operation of our business into the future. Progress required in 2018 was met. Review to be completed in 2019.

- Succession planning is a key challenge for our business and is therefore central to the CEO's objectives. As such his personal objectives required him to transition the leadership of a number of key departments in the year, which was achieved. Actual achievement of succession planning in the year exceeded this, with the next level of management in these departments also refreshed.

- The personal objective was around the promotion and implementation of Safety, Health and Environmental processes. This metric is clearly a critical part of the CEO's role and the Committee determined that he had effectively fulfilled this objective in the year taking into account careful consideration of feedback from the Group SHE Committee.

|

| Rating | The Committee assessed achievement for all objectives with an overall rating of 80% |

| Executive Director | Dominique Yates |

| Overview | For 2018 Dominique's objectives were: define and implement Group IR strategy; recruitment of key finance personnel; review of the ERP system |

| Key achievements in the year | - The CFO was tasked with defining and implementing a new Group Investor Relations strategy in the year. This objective was achieved, and we believe that through this IR strategy the Group will maintain strong relationships and continue productive two-way dialogue with our shareholders.

- Succession planning features in the personal objectives for both our CEO and CFO, and as part of this the CFO was tasked with filling a number of key vacant finance roles across the business. All relevant roles were filled within the required time-frame and so this objective was achieved in full.

- The CFO shared an objective with the CEO around the review of the Enterprise Resource Planning (ERP) programme. Progress required in 2018 was met. Review to be completed in 2019.

|

| Rating | The Committee assessed achievement for all objectives with overall rating of 70%. |

Bodycote Incentive Plan (BIP)

BIP awards made in 2016 had a three-year performance period ending on 31 December 2018, after which they will vest immediately, with 50% of the award subject to satisfaction of a ROCE target and 50% subject to the headline earnings per share (EPS) target.

Over this period total shareholder returns of 21% were achieved demonstrating the strength of the returns we have made to shareholders. The threshold and maximum targets along with the vesting schedule are set out in the tables below.

| ROCE | Headline EPS |

| Performance target | Vesting of element

(% of maximum) | Performance target | Vesting of element

(% of maximum) |

| Threshold performance | 15.5% | 0% | 31.7p | 0% |

| Maximum performance | 23.0% | 100% | 52.0p | 100% |

| Performance achieved | 20.5% | 78.5% | 55.9p | 100% |

If headline EPS at the end of the performance period was below 27p, then no awards will vest. Over the period, ROCE was 20.5% and the headline EPS figure for the year was 55.9p.

The table below sets out the 2016 BIP outcome for S.C Harris. D.F. Landless 2016 BIP award lapsed on his retirement date of 31 December 2016.

| 2016 BIP outcome | |

| S.C. Harris | 89.3% of maximum opportunity |

The table below sets out a summary of shares vesting for BIP awards made in 2016 for S.C. Harris.

| Executive | Award type | Grant date | Number

of shares

granted | End of performance period | % award vesting | Number

of shares

vesting | Vesting date |

| S.C. Harris | 2016 BIP | 13 April 2016 | 151,767 | 31 Dec 18 | 89.3% | 135,467 | 11 Mar 19 |

Legacy Co-Investment Plan (CIP)

As described in Section B: Directors' Remuneration Policy, CIP awards are subject to an absolute TSR target. Executive Directors were invited to purchase shares up to 40% of basic salary (net of tax) against which performance based matching shares are granted on a 1:1 basis. The CIP awards made in 2015 had a three-year performance period ending on 30 April 2018, and vested on 31 May 2018. The absolute TSR performance targets applicable to this award are set out below.

| Absolute TSR performance target | Vesting level |

| 4% CAGR + CPI | 50% (0.5:1 match) |

| 10% CAGR + CPI | 100% (1:1 match) |

Over the three-year period, the Group achieved absolute annual TSR growth of 11.6%. This strong return to shareholders over the period is reflected in the vesting of 98.4% under the CIP. Note that awards are no longer made under the CIP.

The number of shares which vested for S.C. Harris is set out below. As D.F Landless is no longer an Executive Director, vesting under this plan to him is set out under payments to past directors.

Scheme interests awarded in the financial year

CIP awards granted during the year

No awards were made under the CIP – the final award was made in 2015 with vesting occurring in May 2018. This plan no longer features in the Company's policy.

BIP awards granted during the year

Awards consisting of conditional shares were granted to both Executive Directors, equivalent in value to 175% of their base salaries on 18 May 2018, and will vest after three years in March 2021. The performance period will end on 31 December 2020. Details of the awards are set out below. Awards are subject to continued employment and the achievement of ROCE and headline EPS growth performance targets, as summarised in the table below.

The Committee has reviewed the performance targets and these have been revised appropriately to ensure that they remain stretching targets which underpin the Group's objectives. Our long-term targets reflect the continued challenges in the wider commercial environment and the improved growth we expect to see following our emphasis on operational efficiency and the expansion of our footprint in rapid growth territories.

| ROCE | Headline EPS |

| Performance target | Vesting of element (%

of maximum) | Performance target | Vesting of element (%

of maximum) |

| Threshold performance | 17% | 0% | 50p | 0% |

| Maximum performance | 23% | 100% | 64p | 100% |

If headline EPS at the end of the performance period is below 42.5p, then no awards will vest. The Committee has decided that the ROCE figure of 23% is a robust aspiration for the Group in view of our expected programme of investments, recognising the potential for unintended consequences in terms of short-term capital underinvestment for the business. Dividend equivalents are payable in respect of those shares that vest.

The number of shares that were awarded, at a grant price of £9.51, to the Executive Directors during the year is set out below.

| Executive | Award type | Grant date | Number of shares | Market price at date of award | Face value at date of award |

| S.C. Harris | 2018 BIP | 12 April 2018 | 96,911 | £9.51 | £921,624 |

| D. Yates | 2018 BIP | 12 April 2018 | 69,924 | £9.51 | £664,977 |

Chair and Non-Executive Directors' fees

Fees were reviewed against comparable companies of similar size and were effective as of 1 January 2018. The fee payable to the Chair of the Board and other Non-Executive Directors were as follows:

| Individual | Roles | Fee for 2018 | Fee for 2017 | % increase in

NED role fees |

| Eva Lindqvist | - Non-Executive Director

- Chair of Remuneration Committee

- Member of Audit, Remuneration and Nomination Committees

| £65,182 | £63,345 | 2.9% |

| Ian Duncan | - Non-Executive Director

- Chair of Audit Committee

- Member of Audit, Remuneration and Nomination Committees

- Senior Independent Director

| £74,415 | £72,318 | 2.9% |

| Patrick Larmon | - Non-Executive Director

- Chair of Employee Advisory Committee

- Member of Audit, Remuneration and Nomination Committees

| £55,549 | £54,372 | 2.9% |

| Lili Chahbazi | - Non-Executive Director

- Member of Audit, Remuneration and Nomination Committees

| £55,549 | -- | --% |

| Anne C. Quinn | - Non-Executive Chair

- Chair of Nomination Committee

- Member of Nomination Committee

| £225,000 | -- | --% |

Non-Executive Director fees were increased for 2018 based on market benchmarking against Non-Executive Director fees in the FTSE 250 and other companies of similar size and complexity in line with the Policy approved at the 2016 AGM.

The fee for the new Chair, Anne C Quinn, was set at £225,000 to reflect her experience and the skills she will bring to the role. In determining the appropriate fee level the Committee considered market benchmarking against the FTSE 250 and other companies of comparable size and complexity in line with the policy approved at the 2016 AGM.

At 31 December 2018 the aggregate annual fee for all Non-Executive Directors, including the Chair, was £475,695, which is below the maximum aggregate fee allowed by the Company's Articles of Association of £500,000 p.a.

Board changes in 2018

Payments for loss of office

No payments for loss of office were made in the year.

Payments to past directors

As set out in last year's annual report on remuneration, David Landless's Bodycote Incentive Plan (BIP) awarded in 2016 lapsed on his leaving date of 31 December 2016 and the Co-Investment Plan (CIP) awarded in 2015 has been prorated to his leaving date. Vesting of this award has occurred in line with the normal performance conditions and is set out below.

2015 CIP (vested on 31 May 2018)

Over the three-year period, the Group achieved absolute TSR growth of 34.1%. This performance resulted in the TSR targets being achieved at a level of 98.4%. This meant that the number of prorated shares which vested for D.F. Landless was 2,795 at a share price of £9.93 at the date of vesting on 31 May 2018.

He also received dividend equivalents in connection with the 2015 CIP amounting to £2,328.24.

2016 BIP

The award made to David Landless in 2016 lapsed on 31 December 2016, his leaving date.

Directors' shareholdings

As described in Section B: Directors' Remuneration Policy, the Board operates a shareholding retention policy under which Executive Directors and other senior executives are expected, within five years of appointment, to build up a shareholding in the Company. For the purposes of this requirement, only beneficially owned shares and the net of tax value of deferred shares under the annual bonus (as they are not subject to further performance conditions) will be counted.

The shareholding requirement for the CEO is 200% of salary and for the CFO is 200% of salary (increased from 150% under our previous approved policy).

The interests in ordinary shares of directors and their connected persons as at 31 December 2018, including any interests awarded under the annual bonus, CIP or BIP, are presented below along with whether Executive Directors have met the shareholding guidelines. We note that shares under the annual bonus and the BIP are conditional on continued employment until vesting.

As at 8 March 2019, the interests of the Directors were unchanged from those at 31 December 2018.

| Counted towards the

shareholding requirement | Outstanding scheme interests

(not counted towards

shareholding requirement) | Shareholding requirement

met2 |

| Beneficially owned | Deferred shares granted under the annual

bonus3 | Shares subject to performance conditions

BIP1 | Shares subject to performance conditions

CIP2 |

| Executive Directors | | | | | |

| S.C. Harris (200% minimum holding requirement) | 217,121 | 39,560 | 360,247 | -- | Yes |

| D. Yates (200% minimum holding requirement) | 200,000 | 14,013 | 152,840 | -- | Yes |

| Non-Executive Directors (No holding requirement) | | | | | |

| A.C. Quinn (appointed 1/1/18) | 20,000 | | -- | -- | n/a |

| E. Lindqvist | 12,200 | | -- | -- | n/a |

| I.B. Duncan | -- | | -- | -- | n/a |

| P. Larmon | 5,000 | | -- | -- | n/a |

| L. Chahbazi (appointed 1/1/18) | -- | | -- | -- | n/a |

- Figures relate to unvested awards under the BIP.

- The last CIP award took place in 2015 and vested in May 2018. There are now no shares subject to performance condition under the CIP.

- The number of deferred shares under 2019 bonus plan can only be granted after the end of the year-end closed period and will be shown in the 2019 Annual Report. GBP value of the 2019 deferred shares are £259,852 for S. Harris and £137,952 for D. Yates.

Summary of outstanding share awards, including share awards granted during the year – Executive Directors

The interests of the Executive Directors in the Company's share schemes as at 31 December 2018 are as follows. Note that no CIP award was made in 2016 or 2017 with the last award being granted in 2015.

| Interests as at 1 January 2018 | Awarded

in year1 | Vested

in year2 | Lapsed in year | At 31 December 2018 | Market price at award date | Market value at date of vesting | Vesting date 2018 award |

| Bodycote Incentive Plan (BIP) | S.C. Harris | 374,023 | 96,911 | 53,317 | 57,370 | 360,247 | £9.51 | £9.93 | March 2021 |

| D. Yates | 82,916 | 69,924 | – | -- | 152,840 | £9.51 | -- | March 2021 |

| Legacy Bodycote Co-Investment Plan (CIP) | S.C. Harris | 5,113 | – | 5,031 | 82 | -- | £7.48 | £9.93 | May 2018 |

- Mid-market closing price of a share on the day before the BIP 2018 grant was £9.51. The face value of the award to S.C. Harris was £921,624. The face value of the award to D. Yates was £664,977.

- The 2015 BIP award did vest at 48%. The final CIP award vested during the year at 98.4% (details of the relevant performance conditions are set on in the Annual report on remuneration).

- Retired as Group Finance Director on 1 January 2017. D. Yates appointed Chief Financial Officer on 2 January 2017. D. Yates has no awards under the legacy CIP.

End of auditable section

Fees retained for external Non-Executive Directorships

To broaden the experience of Executive Directors, the position of Non-Executive Director may be held in other companies, provided that permission is sought in advance. Any external appointment must not conflict with the Directors' duties and commitments to Bodycote plc. S.C. Harris has held the position of Non-Executive Director of Mondi plc since 1 March 2011 and in accordance with Group policy he retained fees for the year of £97,174.

Comparison of overall performance and pay

The chart below shows the value over the last nine financial years of £100 invested in Bodycote plc compared with that of £100 invested in the FTSE All Share Industrial index. The Committee has chosen this index as it is a broad market index of which Bodycote plc is a constituent and reflects the wider sector in which we operate. The points plotted represent the values at each financial year end.

Historical TSR Performance

Growth in the value of a hypothetical £100 holding over nine years

FTSE All Share Industrial Index comparison based on spot values

The table below shows how total remuneration for the Group Chief Executive, S.C. Harris, developed over the last ten years.

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| Single figure of remuneration £'000 | 531 | 906 | 3,252 | 3,840 | 3,089 | 1,803 | 771 | 875 | 2,280 | 2,649 |

| Annual variable element award (as a % of maximum) opportunity | 5% | 98% | 95% | 73% | 46% | 73% | 20% | 19% | 98% | 68% |

| Long-term incentive vesting (as a % of maximum) | 0% | 0% | 100% | 100% | 99% | 44% | 0% | 0% | 48% | 89% |

Percentage change in remuneration of Group Chief Executive

The table below sets out the percentage change in the Group Chief Executive's remuneration from the prior year compared to the average percentage change in remuneration for the senior management population. The Remuneration Committee has chosen the senior management population as the wider global employee population operates under an incomparable pay structure. The senior management population is the most relevant and comparable population and is primarily based in the UK.

| Chief Executive Officer | Senior management population |

| 2018 (£000) | 2017 (£000) | % change | Average % change |

| Salary | 542 | 527 | 2.9% | 4.7% |

| Annual bonus | 742 | 1,031 | -28% | 7.4%* |

| Total | 1284 | 1,558 | -17% | 5.8%* |

*Average senior management population bonus change is based on the maximum potential bonus payout.

Relative importance of pay spend

The table below shows the total expenditure in relation to staff and employee costs and distributions to shareholders in 2017 and 2018.

| 2018

£m | 2017

£m | % change |

| Staff and employee costs | 291.1 | 283.8 | 2.6% |

| Distributions to shareholders | 81.7 | 30.6 | 166.7% |

Committee membership

During 2018 the Committee was chaired by E. Lindqvist. The Committee also comprised I.B. Duncan, P. Larmon and L. Chahbazi.

The Committee's full terms of reference are available on the Group's website. No Committee members have any personal financial interest (other than as a shareholder), conflict of interest, cross-directorships or day-to-day involvement in the running of the business. We set out below the members of the Committee, the number of meetings each Committee member attended during the year and the main responsibilities of the Committee.

Committee activities

During 2018 the Committee met six times to consider, amongst other matters:

| Theme | Agenda items |

| Best practice | - The Group's Remuneration Policy, discussions and feedback from the Group's AGM in 2018 and the Corporate Governance Code and Investment Management Association (IMA) guidelines on remuneration

- Review of the current UK corporate governance environment and the implications for the Group

|

| Implementation Report | - Consideration and approval of the Implementation Report to be put to shareholders and as summarised in Section A of the Board report on remuneration

|

Executive Directors'

and senior executives'

remuneration | - Basic salaries payable to each of the Executive Directors

- The annual bonus and payments for the year ended 31 December 2017

- The annual bonus structure and performance targets for the year ended 31 December 2018

- The awards and vestings made under the Bodycote Incentive Plan ('BIP')

- The vesting made under Co-Investment Plan ('CIP') during the year

- Pension arrangements for senior executives

|

| Reporting | - Consideration and approval of the Board report on remuneration

- Feedback on shareholder consultation concerning the new Remuneration Policy and approval of the new Policy

|

Advisers to the Committee

The Committee was advised by PwC during 2018 on remuneration matters including providing advice on matters under consideration by the Committee, updates on good practice, legislative requirements and market practice. PwC were appointed by the Remuneration Committee in July 2015 following a competitive tender process. PwC's fees for the year, based on the quantity and complexity of the work undertaken, amounted to £51,000. PwC also undertakes tax and accounting work for the Company. PwC is a founding member of the Remuneration Consultants Group and voluntarily operates under the Code of Conduct in relation to executive remuneration consulting in the UK. The Code of Conduct can be found at remunerationconsultantsgroup.com. The Remuneration Committee is satisfied that the advice provided on executive remuneration is objective and independent, and that no conflict of interest arises as a result of these services. The Committee reviews the objectivity and independence of the advice it receives from PwC at a private meeting each year. Legal advice was provided by Eversheds. All fees are based on the quantity and complexity of work undertaken.

Following the audit tender undertaken in Q3 2018, PwC was appointed as new external auditor by the Board as of 1 January 2019. Consequently PwC resigned as Remuneration Committee consultant on 31 December 2018. The Committee has appointed E&Y as interim Remuneration Consultants as of 1 January 2019.

The Committee also received assistance from the Group Chief Executive and Group Company Secretary, although they do not participate in discussions relating to the setting of their own remuneration. The Committee in particular consulted with the Group Chief Executive and received recommendations from him in respect of his direct reports.

Statement of shareholder voting

The table below displays the voting results on the remuneration resolution at the 2018 AGM as well as the result of the Remuneration Policy at the 2017 AGM:

| 2018 Board

report on

remuneration

(%votes) | 2017 Directors'

Remuneration

Policy

(% votes) |

| Votes cast | 79% | 86% |

| For | 99% | 96% |

| Against | 1% | 4% |

| Number of abstentions | 2,832,323 | 2,034,367 |

E. Lindqvist

Chair of the Remuneration Committee

8 March 2019

Directors' Remuneration Policy

Remuneration Policy

Bodycote's Executive Remuneration Policy is to attract and motivate our senior executive team to execute our strategy and deliver value to our shareholders while ensuring the Group pays no more than is necessary.

The Policy has been revised in order to ensure continued alignment between remuneration and the evolving strategic direction of our business, as well as to ensure alignment with the new UK Corporate Governance Code.

Below is an explanation of how the Bodycote Remuneration Committee has addressed the principles prescribed by the new UK Corporate Governance Code in determining the new Executive Remuneration Policy.

| UK Corporate Governance Code Principles | How the Committee has addressed these |

| Clarity – remuneration arrangements should be transparent and promote effective engagement with shareholders and the workforce. | The Committee is satisfied that the remuneration arrangements in

the new Policy are transparent,comprising simple incentive structures that are commonplace in the market and best practice remuneration provisions. |

| Simplicity – remuneration structures should avoid complexity and their rationale and operation should be easy to understand. | No significant structural changes to incentive plans are proposed within this new Policy. The Committee concluded that the operation of the deferred Annual Bonus and Bodycote Incentive Plan (BIP) would remain easy for stakeholders to understand given the prevalence of these structures in the FTSE market and that the rationale for their operation remains unchanged and is clearly set out within the Policy. |

| Risk – remuneration arrangements should ensure reputational and other risks from excessive rewards, and behavioural risks that can arise from target-based incentive plans, are identified and mitigated. | The Committee concluded that there are two principal approaches to mitigate these risks: to ensure that remuneration arrangements do not offer the potential for excessive rewards; and to ensure the Committee has recourse to recover sums where appropriate. As such, no increases to maximum incentive opportunities are proposed in the new Policy and the malus and clawback provisions for the annual bonus and Bodycote Incentive Plan (BIP) have been extended to include a provision for the action or conduct of a participant which results in reputational damage to the Group. |

| Predictability – the range of possible values of rewards to individual directors and any other limits or discretions should be identified and explained at the time of approving the policy. | The unpredictability of company performance, including share price performance, means that the Committee cannot provide certain future values of Executive Director remuneration. However, in order to provide a guideline range of outcomes possible under the Policy, the 'illustration of application of remuneration policy' chart indicates the potential impact of share price appreciation on Executive Director pay outcomes for both on-target and maximum performance scenarios. |

| Proportionality – the link between individual awards, the delivery of strategy and the long-term performance of the company should be clear. Outcomes should not reward poor performance. | The Committee believes that the Policy table clearly sets out how each element of remuneration links to the delivery of strategy and that the disclosure of BIP performance targets provides a clear link between individual awards and the long-term performance of the Company. The Policy also provides the Committee with discretion to adjust incentive outcomes so that reward fairly and accurately reflects the performance of the Company over the relevant period. |

Alignment to culture – incentive schemes should drive

behaviours consistent with company purpose, values and strategy. | The Committee assessed the incentive plans and considered that they were consistent with Bodycote's values: Honesty and Transparency: The incentive designs are simple, transparent and in line with market practice, facilitating understanding by all stakeholders. Respect and responsibility: The Committee has recourse to recover sums where appropriate. Creating value: The incentives are calibrated to reward participants for delivering exceptional performance. The Committee reviews all outcomes for executive directors and has discretion to adjust outcomes where appropriate. |

This Policy is intended to apply for three years from the date of the 2019 AGM and is set out below.

Discretion

In line with the new Corporate Governance Code provision for remuneration policies to enable the use of discretion to override formulaic outcomes, the Committee has discretion in several areas of Policy as set out in this report. The Committee may also exercise operational and administrative discretions under relevant plan rules approved by shareholders as set out in those rules. In addition, the Committee has the discretion to amend Policy with regard to minor or administrative matters where it would be, in the opinion of the Committee, disproportionate to seek or await shareholder approval.

Executive Remuneration Policy

The table below sets out the key components of Executive Directors' pay packages, including why they are used and how they are operated in practice.

Remuneration Policy Table

| Element and how it supports our strategy | Operation of the element | Maximum

opportunity under the element | Performance measures |

Base salary

To award competitive salaries to attract andretain thetalent required to execute the strategy while ensuring the Group pays no more than is necessary. | Base salaries for Executive Directors are typically reviewed annually (or more frequently if specific circumstances necessitate this) by the Committee in December each year. Salary levels are set and reviewed taking into account a number of factors including: - Role, experience and performance of the executive.

- The Company's guidelines for salaries for all employees in the Group for the forthcoming year.

- The competitiveness of total remuneration assessed against FTSE 250 companies and other companies of similar size and complexity, as appropriate.

| While the Committee has not set a maximum level of salary, ordinarily, salary increases will not exceed the average increase awarded to other Group employees. Increases may be above this level in certain exceptional circumstances, which may, for example, include: - Increase in scope or responsibility.

- A new Executive Director who is being moved to market positioning over time.

In general an Executive Director with the same scope and role throughout the Policy period will retain the same salary other than potential changes in line with all other Group employees. | None. |

Benefits

Provides market – competitive benefits at an appropriate cost | The Company provides a range of cash benefits and benefits in kind to Executive Directors in line with market practice. These may include the provision of company car (or allowance), private medical insurance, short and long-term sick pay and death in service cover. The Company may also meet certain mobility costs, such as relocation support, expatriate allowances, temporary living and transportation expenses. Benefits provision will also extend to the reimbursement of taxable work-related expenses, such as travel. The provision of other benefits payable to an Executive Director is reviewed by the Committee on an annual basis to ensure appropriateness in terms of the type and level of benefits provided. In the case of non-UK executives,the Committee may consider providing additional allowances in line with relevant market practice, including expatriate benefits. | The Committee has not set a maximum level of benefit, given that the cost of certain benefits will depend on the individual's particular circumstances. However, benefits will be set at an appropriate level against market practice and needs for specific roles and individual circumstances. | None. |

Pension

Provides a market- competitive benefit in order to attract the talent required to execute the strategy and provide a market- competitive level of provision for post- retirement income | The Group operates a defined contribution scheme. Executive Directors are provided with a contribution to this scheme or a cash allowance of equivalent value. Base salary is the only pensionable element of remuneration. The same general approach applies to all employees, although contribution levels vary by seniority. Pension contributions for new Executive Directors are to be aligned to those applicable to other employees and will be set at the time of appointment. | Legacy company contribution (or cash equivalent) of up to 25% remains for current Executive Directors. | None. |

Annual bonus

To incentivise delivery of corporate strategy on an annual basis and reward delivery of superior performance. The deferred portion of the bonus supports longer-term shareholder alignment. | The level of bonus paid each year is determined by the Committee after the year end based on performance against targets. A portion of the annual bonus is paid in cash shortly after the financial year end with the remaining portion deferred for three years in Bodycote shares (see details below). Dividend equivalents are payable in respect of the shares which vest. Thirty-five per cent of any bonus earned is deferred into shares for three years, conditional on continued employment until the vesting date. Malus provisions apply for the duration of the performance period and to shares held under deferral. Clawback provisions apply to cash amounts paid for three years following payment. Malus and/or clawback may be applied in the following scenarios: - Discovery of a material misstatement resulting in an adjustment in the audited accounts of the Group or any Group Company;

- The assessment of any performance condition or condition was based on error, or inaccurate or misleading information;

- The discovery that any information used to determine the cash payment under the bonus or the number of shares subject to deferral was based on error, or inaccurate or misleading information;

- Action or conduct of a participant which amounts to fraud or gross misconduct; or

- Action or conduct of a participant which results in reputational damage to the Group.

The Committee believes that the rules of the Plan provide sufficient powers to enforce malus and clawback where required. | The maximum potential is 200% of base salary for the CEO and 150% of base salary for the CFO and other Executive Directors. At the threshold performance level there will normally be no more than 30% vesting. Awards commence vesting progressively from this point with maximum performance resulting in awards vesting in full. | The Committee considers the performance conditions selected for the annual bonus to appropriately support the Company's strategic objectives and provide a balance between generating profit and cash to enable the Group to pay a dividend, reward its employees and make future investments; and achieve other strategic goals to drive long-term sustainable return. The weighting of the measures and specific targets are reviewed on an annual basis to ensure alignment to strategy and are set to be in line with budget. Information on measures and weights that will apply for specific years will be included in the relevant year's Annual Report on Remuneration. At least 70% of the bonus will be based on the achievement of Group financial targets. The Committee retains discretion in exceptional circumstances to change performance measures and targets and the weightings attached to performance measures part way through a performance year if there is a significant and material event which causes the Committee to believe the original measures, weightings and targets are no longer appropriate. Discretion may also be exercised in cases where the Committee believe that the bonus outcome is not a fair and accurate reflection of business performance. The exercise of this discretion may result in a downward or upward movement in the amount of bonus earned resulting from the application of the performance measures. Any adjustments or discretion applied by the Committee will be fully disclosed in the following year's Remuneration Report. The Committee is of the opinion that given the commercial sensitivity arising in relation to the detailed financial targets used for the annual bonus, disclosing precise targets for the annual bonus plan in advance would not be in shareholder interests. Actual targets, performance achieved and awards made will be published at the end of the performance periods so shareholders can fully assess the basis for any pay- outs under the annual bonus. |

Bodycote Incentive Plan (BIP) 2016

To incentivise delivery of long-term strategic goals and shareholder value and aid retention of senior management. | Awards will be granted annually under the Bodycote Incentive Plan subject to a three year vesting period and stretching performance conditions measured over three years. Awards granted from 2019 will also have a two-year holding period from the date of vest. Dividend equivalents are payable in respect of the shares which vest. he Committee retains the discretion in exceptional circumstances to adjust the vesting outcome or the targets for awards as long as the adjusted targets are no less stretching. In such an event the Committee will consult with major shareholders and will clearly explain the rationale for the changes in the report on remuneration. Discretion may also be exercised in cases where the Committee believes that the outcome is not a fair and accurate reflection of business performance. The exercise of this discretion may result in a downward or upward movement in the amount of the LTIP vesting resulting from the application of the performance measures. Malus provisions apply for the duration of the performance period. Clawback provisions apply to amounts for two years following vesting. Malus and/or clawback may be applied in the following scenarios: - Discovery of a material misstatement resulting in an adjustment in the audited accounts of the Group or any Group Company;

- The assessment of any performance condition or condition was based on error, or inaccurate or misleading information;

- The discovery that any information used to determine the number of shares subject to an award was based on error, or inaccurate or misleading information;

- Action or conduct of a participant which amounts to fraud or gross misconduct; or

- Action or conduct of a participant which results in reputational damage to the Group.

The Committee believes that the rules of the Plan provide sufficient powers to enforce malus and clawback where required. | The maximum face value of an award which may be granted under the Plan in any year is up to 175% of base salary for the Executive Directors. At the threshold performance level there will normally be no more than 0% vesting. Awards commence vesting progressively from this point with maximum performance resulting in awards vesting in full. | Awards vest based on performance over three years against performance measures chosen by the Committee to align with business and strategic priorities. The measures for Executive Directors are: In addition, the vesting of awards may only occur if headline EPS is above a defined hurdle level. The Committee considers these performance conditions selected for the BIP to currently appropriately underpin the Company's strategic objectives. Due to the nature of the Company's activities the Committee consider ROCE to provide shareholders with an appropriate measure of how well the Company is performing and is being managed, while headline EPS provides a measure of the level of value created for shareholders. ROCE and headline EPS are our top two KPIs as shown in the Highlights of this Annual Report. The Committee may adjust the performance measures attaching to awards and the weighting of these measures if it feels this will create greater alignment with business and strategic priorities. A significant change to the measures used would only be adopted following consultation with major shareholders. The targets for the performance measures are reviewed on an annual basis to ensure alignment to strategy and are set to be in line with budget. Details of performance targets will be included in the relevant year's Annual Report on Remuneration. |

Shareholding requirement

To provide alignment of interest between participants and shareholders. | The Board operates a shareholding retention policy under which Executive Directors are expected, within five years from appointment, to build up a shareholding in the Company. The Committee has the power to introduce a post cessation of employment minimum shareholding requirement in line with the UK Corporate Governance Code and will review emerging market practice before determining the extent of any terms or conditions of any requirements. | Executive Directors are required to build up a holding of 200% of base salary. | None. |

Notes to the Remuneration Policy Table

The Committee reserves the right to make any remuneration payments and payments for loss of office notwithstanding that they are not in line with the Policy where the terms of the payment were agreed (i) before the Policy came into effect or (ii) at a time when the relevant individual was not a Director of the Company and, in the opinion of the Committee, the payment was not in consideration for the individual becoming a Director of the Company. For these purposes 'payments' include the Committee satisfying awards of variable remuneration and, in relation to an award over shares, the terms of the payment being 'agreed' at the time the award is granted.

Executive Directors' remuneration is reviewed annually and takes into account a number of factors. The Company adopts a policy of positioning fixed pay for all its employees at a level which is competitive to market but which does not require the Company to pay any more than is necessary. Senior and high performing individuals at all levels and across all functions within the organisation are invited to participate in both annual and long-term incentive arrangements, which are similar to those offered to the Executive Directors to ensure reward strategy is calibrated to provide substantive reward only on achievement of superior performance.

Non-Executive Director (NED) Fee Policy

The Policy on Non-Executive Director (NED) and Chair fees is set out below.

| Element and how it supports our strategy | Operation of the element | Maximum

opportunity under the element | Performance measures |

Fees for Non-Executive Directors To attract NEDs who have a broad range of experience and skills to oversee the implementation of our strategy. | The fees for the Non-Executives are determined by the Chair and the Group Chief Executive. The fee for the Chair is set by the Remuneration Committee. The Chair and Non-Executive fees are reviewed on an annual basis. When reviewing fees, the primary source of comparative market data is FTSE 250 companies and other companies of similar size and complexity, as appropriate. The fees for the Chair and Non-Executives are set at a level that will attract individuals with the necessary experience and ability to make a significant contribution to the Group's affairs. The fees reflect the time commitment and responsibilities of the roles. The Chair and Non-Executive Directors are not entitled to any pension or other employment benefits and, in line with the UK Corporate Governance Code, are not allowed to participate in any incentive plan. The Company will pay reasonable expenses incurred by the Non-Executive Directors and Chair and may settle any tax incurred in relation to these. | Fees for Non-Executive Directors for the following year are set out in the statement of implementation of Policy. The Company's Policy is that the Chair and Non-Executive Directors receive a fixed fee for their services as members of the Board and its Committees. The fee structure may also include additional fees for chairing a Board Committee and/or further responsibilities (for example, Senior Independent Directorship). | None. |

Fees retained for External Non-Executive Directorships

To broaden the experience of Executive Directors, they may hold positions in other companies as Non-Executive Directors provided that permission is sought in advance. Any external appointment must not conflict with the Directors' duties and commitments to Bodycote plc.

Statement of consideration of employment conditions elsewhere in the Group

The Company adopts a policy of positioning fixed pay for all its employees at a level which is competitive to the market but which does not require the Company to pay any more than is necessary. Senior and high-performing individuals at all levels and across all functions within the organisation are invited to participate in both annual and long-term incentive arrangements, similar to the executive directors to ensure reward strategy is calibrated to provide substantive reward only on achievement of superior performance.

The Committee does not consult directly with employees when formulating Executive Director pay policies. However, it does take into account information provided by the Human Resources function on pay and conditions across the Company, and considers these as part of its discussions and decision making, along with feedback from employee satisfaction surveys. In addition, the Board of Bodycote is developing its approach to engagement with the workforce in line with the guidance in the new Corporate Governance Code and the results of this engagement will be available to the Remuneration Committee.

We recognise the Government's recent commentary in this area, and will ensure that our approach to consideration of employee views and pay and conditions across the Company reflect appropriate legislative and corporate governance requirements.

Statement of consideration of Shareholders' Views

The Committee always welcomes the views of shareholders in respect of pay policy as well as those views expressed on behalf of shareholders by their respective proxy advisers. The Committee documents all remuneration related comments made at the Company's AGM and feedback received during consultation with shareholders throughout the year. Any feedback received is fully considered by the Committee.

In developing the proposed Remuneration Policy for 2019 and beyond the Remuneration Committee engaged extensively with the Company's key shareholders and their representative bodies. Through this process the Remuneration Committee took on board the feedback received and refined the proposed Remuneration Policy as appropriate to ensure it meets the expectations of our shareholders.

Approach to Recruitment Remuneration

When recruiting new Executive Directors, the Company's Policy is to pay what is necessary to attract individuals with the skills and experience appropriate to the role to be filled, taking into account remuneration across the Group, including other senior executives, and that offered by other FTSE 250 companies and other companies of similar size and complexity. New Executive Directors will generally be appointed on remuneration packages with the same structure and pay elements as described in the Policy table.

| Component | Policy |

| General | The Company's Policy is to pay what is necessary to attract individuals with the skills and experience appropriate to the role to be filled. The initial notice period may be longer than the Company's one year policy (up to a maximum of two years). However, this will reduce by one month for every month served, until the Company's Policy position is reached. |

| Base salary | Base salary levels will be set at an appropriate level to recruit the best candidate in consideration of the new recruit's existing salary, location, skills and experience and expected contribution to the new role, the current salaries of other Executive Directors in the Company and current market levels for the role. |

| Other benefits | Other benefits will be considered in light of the Policy in place for the other Executive Director(s). If it is in the best interests of the Company and shareholders, the Committee may consider providing additional benefits. |

| Pension | Pension contribution levels will be considered by the Committee in light of the new recruit's package as a whole, market practice at the time and in line with the new provision that Executive Director pension contributions will be in line with Bodycote contribution rates applicable to other employees. |

| Annual bonus | Normal awards will be made under the annual bonus plan in line with the Remuneration Policy. The Executive Director may be invited to participate in the bonus on a prorated basis in the first year of appointment. |

| Long-term incentives | Normal awards will be made under the BIP in line with the Remuneration Policy. The Executive Director may be invited to participate in 'in flight' BIP awards on a prorated basis when appointed. The Company is required to set out the maximum amount of variable pay which could be paid to a new Director in respect of his/her recruitment. In order to provide the Company with sufficient flexibility in a recruitment scenario, the Committee has set this figure as 450% of base salary. This covers the maximum annual bonus and the maximum face value of any long-term incentive awards. This level of variable pay would only be available in exceptional circumstances, and in order to achieve such a level of variable pay, stretching targets would need to be met. For the avoidance of doubt, this 450% variable pay limit excludes the value of any 'buyout' payments or awards associated with forfeited awards. |

| Replacement awards | For an external appointment, although there are no plans to offer additional cash and/or share-based payments on recruitment, the Committee reserves the right to do so when it considers this to be in the best interests of the Company and shareholders. Such payments may take into account remuneration relinquished when leaving the former employer and would reflect the nature, time horizons and performance requirements attached to that remuneration. Shareholders will be informed of any such payments at the time of appointment. The Committee may make awards on hiring an external candidate to 'buyout' awards which will be forfeited on leaving the previous employer. Our approach to this is to carry out a detailed review of the awards which the individual will lose and calculate the estimated value of them. In doing so, we will consider the vesting period, the option exercise period if applicable, whether the awards are cash or share based, performance related or not, the company's recent performance and payout levels and any other factors we consider appropriate. If a buyout award is to be made, the structure and level will be carefully designed and will generally reflect and replicate the previous awards as accurately as possible. We will make the award subject to appropriate malus and clawback provisions in the event that the individual resigns or is summarily terminated within a certain time frame. An explanation will be provided at the time of recruitment of why a buyout award has been granted. |

| Internal promotions | For internal promotions any commitments made prior to appointment may continue to be honoured as the executive is transitioned to the new remuneration arrangements. |

Shareholders will be informed of any Director appointment and the individual's remuneration arrangements as soon as practicable following the appointment.

Fee levels for a new Chair or new Non-Executive Directors will be determined in accordance with the Policy.

Service Contracts

All Directors' service contracts and letters of appointment are available for inspection at the Company's registered office.

A summary of the key terms of the Executive Directors' service contracts is set out below:

| S.C. Harris, Group Chief Executive | D. Yates, Chief Financial Officer |

| Date of service contract | 6 October 2008 | 1 November 2016 |

| Notice period | 12 months | 12 months |

| Remuneration | - Annual base salary

- Potential for cash in lieu of pension

- Reimbursement of expenses (if satisfactory evidence provided)

- Private medical insurance

- Company car allowance